Sebastian Mallaby on DeFi, Power Laws, & Politics

A noted historian talks crypto, crashes, & great power conflict

This interview was published by Chainmail, a prior newsletter covering the politics of digital finance.

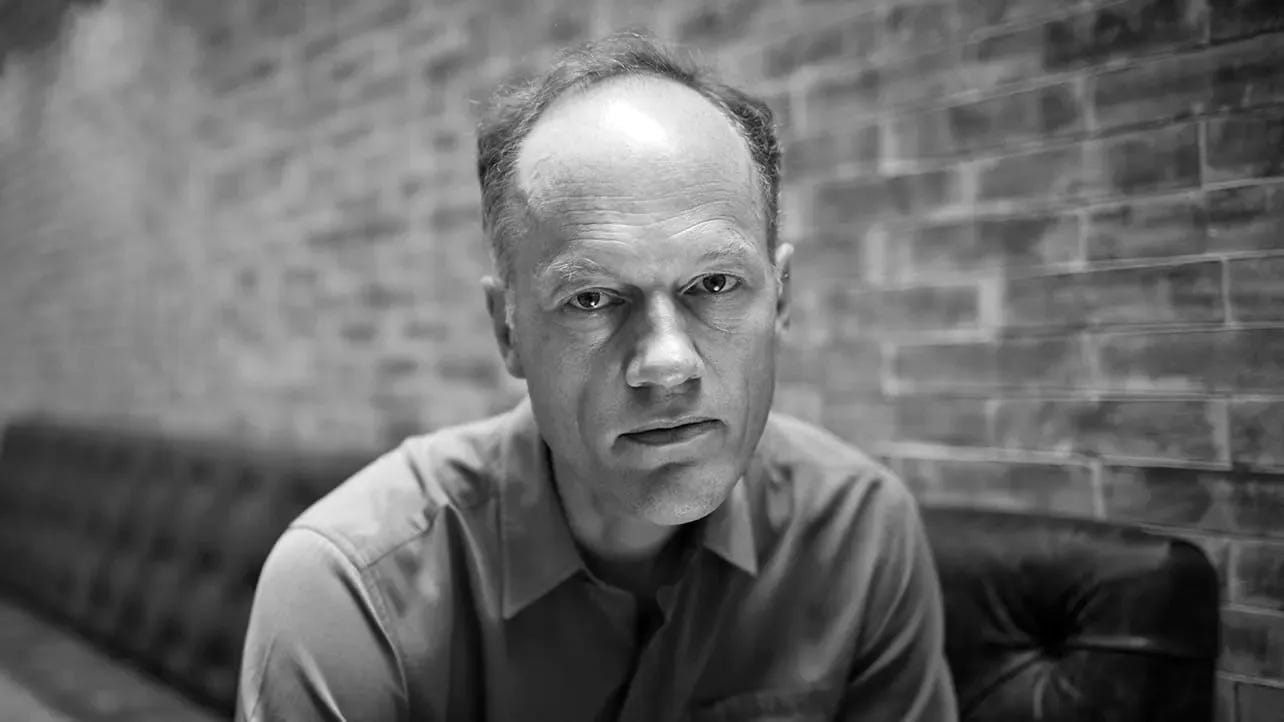

To kick off Chain Mail’s interview series on the geopolitics of crypto, I had the pleasure of interviewing Sebastian Mallaby, the Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations. Mallaby is an accomplished journalist and author of several excellent books on modern finance and politics, including most recently The Power Law: Venture Capital and the Making of the New Future. You can find his columns at The Washington Post and follow him on Twitter as @scmallaby. What follows is a lightly edited transcript of our interview conducted by email.

CM: Your recent book, The Power Law, explores the history and future prospects of venture capital. What insight does that project give you on the crypto economy given that many new ventures emerge in Silicon Valley? What about VC culture might help policymakers better understand the rise of digital assets?

SM: I called my book The Power Law because the central idea in venture capital is that low-probability, high-impact investments are worth making. In a power law distribution, a high probability of failure is unremarkable; all the returns will come from the huge multiples on the few projects that beat the odds and succeed. This same mentality animates crypto. If you were to ask, “Is crypto certain to work?” the answer would be no. “Is it likely to work?” Even that is debatable, given that we are thirteen years into the crypto story and we have yet to see a lot of use cases that affect people outside the crypto ecosystem. “But might it work?” Absolutely. If I were a venture capitalist I would be backing crypto projects. They fit the high-risk/high-impact model perfectly.

Beijing has been clamping down on a host of tech companies and non-state digital currencies while also conducting trial runs for a digital yuan. In the US, an Executive Order from the Biden Administration has laid out a cautiously optimistic approach to regulating crypto while exploring a potential US central bank digital currency. How could state competition in the digital asset space deepen or extend great power conflict?

Of course, we are early in the development of central bank digital currencies (CBDCs) and we can’t be sure how this will play out. But for the moment I see CBDCs as marginal. Central banks are not going to want to interface directly with corporate and retail customers: that would place a huge burden on them, and it would kill financial services innovation completely. It would also exacerbate the risk of bank runs. The moment customers lost confidence in bank deposits or other instruments, they would dump them and buy CBDCs; paradoxically, providing a super safe form of money renders the rest of the financial system less safe. Because of all this, CBDCs will probably be used in a limited way, with central banks perhaps providing this form of money to commercial banks in lieu of the reserves they use now. Will that be a major innovation? I doubt it.

You argued in a recent column that, despite perennial warnings, dollar dominance isn’t budging. Sovereign financial powers come and go through the centuries. Could a digital yuan, or other CBDCs, undermine the dollar’s status as global reserve currency in the long term? What kind of time horizon should policymakers consider as they take a whole-of-state approach to crypto and CBDCs?

China has been trying to internationalize the yuan at least since the 2008 financial crisis. It has made only symbolic headway because people don’t want to hold a currency issued by a government that (a) does not always respect the rule of law; and (b) regulates finance such that the variety of financial instruments available to savers and users of capital is limited. I don’t think that a Chinese CBDC will change this. If anything, a government-issued digital currency is likely to be used as a tool of social control. Savers who have a choice will go elsewhere.

Niall Ferguson has argued that “DeFi looks like a bona fide revolution.” Do you share this assessment? Is it possible to know, without the aid of hindsight, whether one is witnessing a revolution in the financial system?

Niall’s essay is one of the best statements on crypto I have read. It also happens to match my views pretty closely. DeFi projects such as Uniswap are extraordinary in their impact and sophistication. The question is whether they will “cross the chasm” and link up with the fiat currency world. Given the risks from a regulatory clamp down, a breakthrough in quantum code-breaking that undermines the cryptographic basis of crypto, and other unknown unknowns, we can’t say for sure that the chasm will be crossed. But I do think that a crossing is probable, and that Niall’s prediction of a “bona fide revolution,” or at least “bona fide advance,” will prove true.

The recent market cycle has shown a tight correlation between crypto and tech stocks, despite many advocates pitching some forms of crypto as counter-cyclical investments. Does this surprise you? Does this undermine crypto advocates’ claims that digital assets are, in the long term, an effective hedge?

The digital asset that was supposed to go up in an inflationary environment is Bitcoin. Its failure to do so suggests that for the moment it is not really established as digital gold. Rather, it is a venture bet on the idea that it will become digital gold. Because Bitcoin trades like a venture asset, at least for now, it rises in risk-on periods and vice versa.

Total crypto market capitalization has more than halved since November 2021, according to data from CoinMarketCap. What might the history of financial bubbles tell us about this moment in digital assets? What are the historical corollaries?

The optimistic, and I think the best, corollary is the tech bust of 2000. Then, consumer internet companies that had built audiences by spending VC dollars on advertizing went into the tank: the dot-coms became dot-bombs. Some of those companies were indeed worthless and deserved to get washed out. But it turned out that many of them were merely early — the same ideas formed the basis for successful e-commerce in later years. If this analogy is the right one, the crypto ecosystem will come through better and stronger in a few years from now.

Some have argued that decentralized finance suffers from the same problems of complexity and opacity that afflicted shadow banking in the run-up to the global financial crisis. Is this a fair analogy? Might crypto risks trigger further disruption in traditional financial channels? By that same token, are US policymakers, particularly those at the Treasury and Federal Reserve, giving enough attention to digital asset markets?

On the eve of the financial crisis, in 2007, the global shadow banking system peaked at $62 trillion, according to a measure devised by the Financial Stability Board, which brings together central banks. This is fully twenty times larger than crypto was at its peak in 2021. So I think crypto remains too small to threaten the stability of the financial system. The recent collapse of Luna, which did not impact traditional finance, supports this view. The US government is therefore right to allow crypto to grow without excessive regulation. The innovation in DeFi could prove to be valuable for all of society. There is a public interest in allowing builders to build.

What, in your view, is lacking in the discussion surrounding digital assets? What might policymakers, pundits, and investors be missing?

I’m struck by how people in traditional finance sometimes dismiss crypto wholesale, but also by how people in crypto seem indifferent to projects that attempt to bridge into the fiat system. Each side seems happy more or less to stick in its own lane. To me, hybrid projects that mix the advantages of crypto with traditional business models are exciting. An example is Braintrust, a marketplace that big corporates use to hire developers. Braintrust issues a token to incentivise users of the marketplace to bring in new participants and perform other services for the community. It’s an interesting model and I am excited to see how it plays out.